Expanding Global Demand Opens Opportunities for U.S. Bulk Wine

Printer-friendly PDF (70.66 KB)

Record World Wine Trade in 2013

Global wine trade climbed to a record 5 billion liters in 2013, up 75 percent from little more than a decade ago. Although the majority of trade is in bottled wine, half of the recent growth has been in bulk wine. Bulk wine trade has grown 155 percent since 2003, thanks to advantages such as lower import duties and lower packaging, handling and transportation costs compared to bottled wine.

Expanded Global Demand

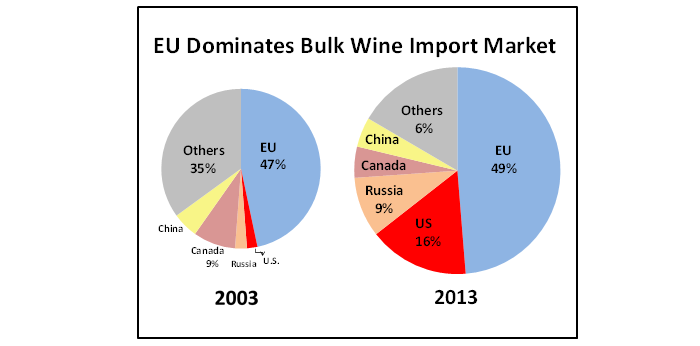

The European Union remains the dominant importer of bulk wine, with imports nearly tripling from 330 million liters to 930 million liters over the past decade. Demand in Russia and the United States has also surged. Changes in tastes and preferences, demographics, spending habits and purchasing patterns are fuelling the demand. Younger consumers reportedly prefer inexpensive, imported bulk wines that are now readily available in supermarkets and local retail outlets and are generally consumed at home. The shift to in-home consumption has also led to increased purchases of bulk wine that retailers have repackaged with their own labels.

Increased Export Competition

Although the EU and South America have historically dominated exports of bulk wine, Australia and South Africa have greatly expanded their exports. As a result, their combined market share now accounts for 40 percent, up from only 22 percent a decade earlier. South Africa’s weaker currency has given the country a comparative advantage. Australian exporters are shipping more lower-priced wine in bulk because of their stronger currency and higher bottling costs.

New Opportunities for the United States

U.S. exports of bulk wine, though still fairly small, have expanded from 50 million liters to 175 million liters since 2003. Bulk wine exports now account for more than 40 percent of total U.S. wine shipments. Changing trade barriers, lower taxes and simplification of import regulations are expected to improve sales opportunities.