Cultivating Opportunities for U.S. Agricultural Exports to Hong Kong

Contact:

Link to report:

Executive Summary

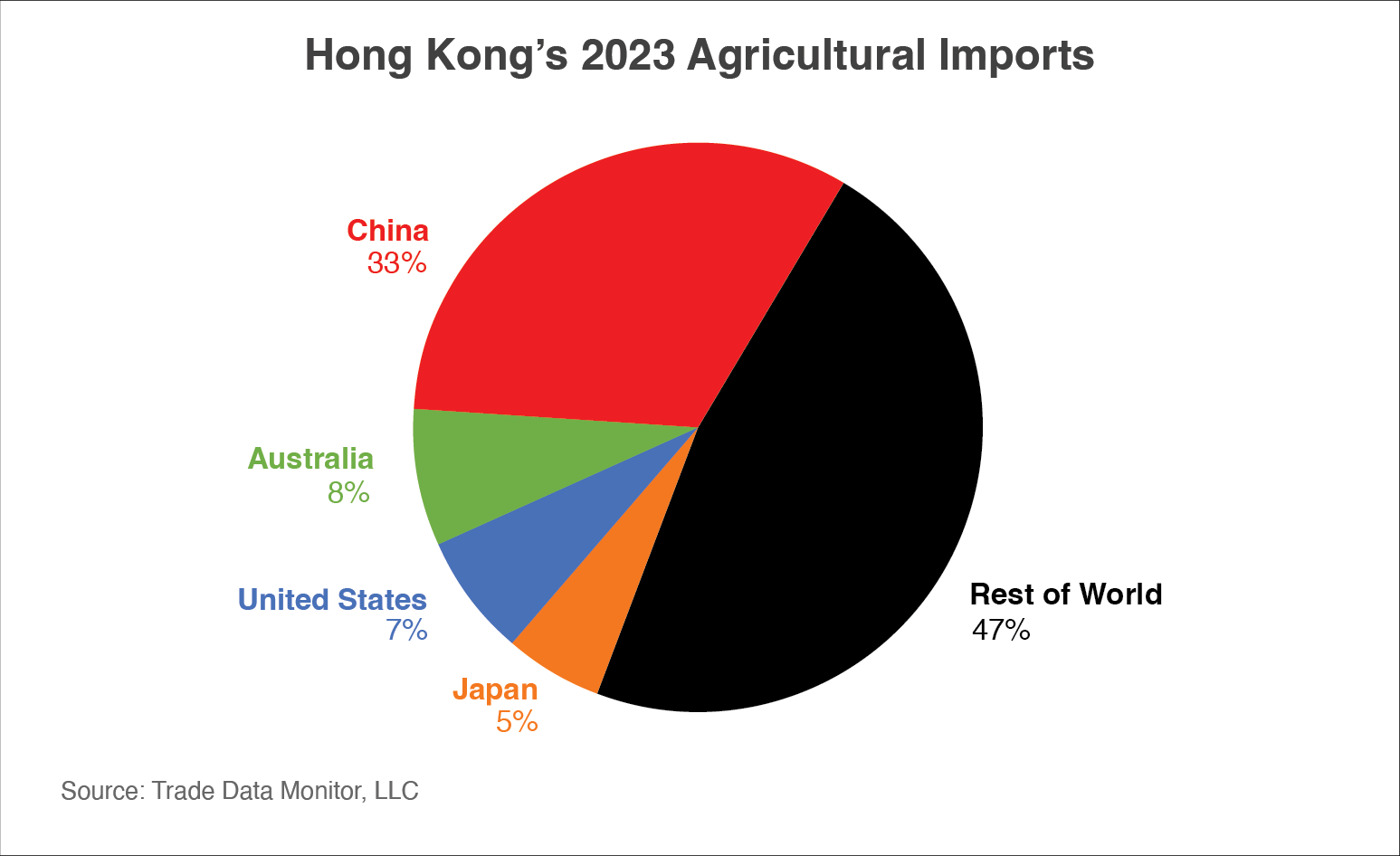

In 2023, Hong Kong was the 17th-largest market for U.S. agricultural products globally. That same year, the United States exported $1.5 billion of agricultural products and was the third-largest supplier of consumer-oriented food products to Hong Kong after China and Australia. Hong Kong is a significant market for U.S. exports of beef, poultry, tree nuts, and other agricultural products. Hong Kong’s total imports of agricultural products were $19.7 billion, and its economy grew 3.3 percent in 2023. Hong Kong’s economy has not fully returned to pre-pandemic levels due to a significant decline in tourism, a shift in global businesses, particularly financial services, away from Hong Kong to places like Singapore, and an increasing trend of locals traveling to mainland China for shopping and dining. However, Hong Kong’s economy has stabilized and returned to growth, and its government is taking action to boost tourism and investment. Export opportunities exist due to duty-free imports of foods and beverages, an affluent consumer base, Hong Kong’s status as a major trading hub for other Asian markets, and the perception that U.S. agricultural products are of high quality.

Macroeconomic Perspective

In 2023, Hong Kong had a population of 7.5 million, and its per capita gross domestic product was more than $50.5 thousand, one of the highest in Asia. Hong Kong is a vibrant, cosmopolitan city with sophisticated consumers with a median age of 47.2 years. As a densely populated urban area with 3.2 percent arable land, Hong Kong relies on imports for 95 percent of its food supply, and all food and beverage product imports are duty-free with the exception of distilled spirits, whose duties were lowered in 2024 on value above the Hong Kong dollar (HKD) $200 ($25.64) per liter to 10 percent. The HKD, pegged to the U.S. dollar, provides foreign exchange stability for both local importers and U.S. agricultural exporters.

A combination of the 2018-2019 U.S. trade dispute with China, followed by the global Covid pandemic, led to a significant decline in U.S. agricultural exports to Hong Kong. U.S. agricultural exports to Hong Kong peaked at $4.2 billion in 2017, with a U.S. market share of 17 percent, before falling to $1.5 billion in 2023 and a 7-percent market share. Most of this decline was in consumer-oriented foods, such as beef, tree nuts, fresh fruit, and poultry, and is attributed to a drop in tourism resulting from the Covid pandemic. However, tourism in Hong Kong has started to recover in 2024, and the demand for imported foods is expected to recover, too, thus providing an opportunity for U.S. agricultural exporters.

Prospects for U.S. Agricultural Exports

Hong Kong will continue to be an important market for U.S. agricultural and food exports. Demand for imported consumer-oriented agricultural goods will remain strong in the coming years as macroeconomic conditions are projected to improve, consumer purchasing power to rise, and the tourism industry to rebound. Although U.S. agricultural exports are down dramatically from their pre-pandemic highs in 2017, U.S. products, particularly consumer-oriented goods, are well known and well received by Hong Kong customers because of enforceable U.S. food safety standards and the consistent quality of U.S. products, including organic, all-natural, health, and gourmet food products. Hong Kong also accepts use of the U.S. Department of Agriculture (USDA) organic label. U.S. agricultural export products with favorable prospects include beef and beef products, poultry and poultry products, pork and pork products, alcoholic beverages, tree nuts, fresh fruits (cherries, apples, citrus fruits, blueberries), condiments and sauces, candy/confectionary, food preparations (soups, baking mixes, etc.), and seafood.

Beef and Beef Products

Exports of U.S. beef and beef products to Hong Kong were valued at $415.0 million in 2023, up 6 percent from 2022, but down 57 percent from their all-time high of $963.0 million in 2018. The United States is Hong Kong’s second-largest beef supplier by volume, after Brazil. Consumers favor U.S. beef and command a premium price due to its reputation as a safe and high-quality product.

Poultry and Poultry Products

Exports of U.S. poultry and poultry products (not including eggs) to Hong Kong were valued at $105.0 million in 2023, down 77 percent from its high of $468.0 million in 2017. The market potential for poultry is strong given its popularity in the local diet, demand for high-quality imports, and the reputation of U.S. poultry as high quality, safe, and reliable. Consumers favor poultry, particularly chicken paws and wing tips, due to their lower cost and versatility. U.S. poultry exporters are well positioned to retain a strong foothold in the Hong Kong market.

Pork and Pork Products

U.S. exports of pork and pork products fell by 7 percent from $33.0 million in 2022 to $31.0 million in 2023 and are down 93 percent from their high of $415.0 million in 2017. However, the market potential for U.S. pork and pork products remains strong given the high demand for pork in the local cuisine and a rebounding tourism sector post-Covid. Pork ribs and offal are the most popular items among Hong Kong consumers. Pork is a staple in Hong Kong’s diet in various dishes such as barbequed pork, dumplings, stir fries, and noodle dishes. Pork comprises a significant portion of meat consumption and will continue to be one of the most popular proteins.

Alcoholic Beverages

Alcoholic beverage imports from all sources reached $44.2 million in 2023, led by U.S. exports of distilled spirits, up 79 percent from 2022. In 2023, the United States exported $4.6 million of distilled spirits to Hong Kong, with bourbon accounting for more than two-thirds of total sales. According to a USDA Global Agricultural Information Network report, in October 2024, the Hong Kong Government announced a significant reduction in the duty on imported alcoholic beverages with an alcohol content above 30 percent by volume. The new policy reduced the duty on value above HKD $200 ($25.64) per liter to 10 percent and is expected to support the greater consumption of distilled spirits while being particularly beneficial to premium brands. Additionally, Hong Kong has a growing and vibrant cocktail culture, including the number 1 bar in Asia and 4 of the top 10 bars in Asia. Given this growing cocktail scene, there is particularly strong potential for U.S. whiskeys.

U.S. exports of wine to Hong Kong dropped 35 percent to $39.0 million in 2023 from $60.0 million in 2022 and its high of $130.0 million in 2018. However, Hong Kong remains a significant market for U.S. wines and was the seventh-largest market for U.S. exports of wines in 2023 by value. As Hong Kong has no domestic wine production, all wine consumed is imported, and increasing consumer awareness of the value and characteristics of U.S. wines could better position these products for market growth. U.S. exports of beer declined from $340.0 thousand in 2022 to $168.0 thousand in 2023. However, beer is a popular beverage among Hong Kong residents and tourists; imported lager is still the largest category, and the Hong Kong market offers immense re-export opportunities. Additionally, beverages with less than 30 percent alcohol content are not subject to an excise duty, presenting opportunities for U.S. exports of beer to grow in the Hong Kong market.

Tree Nuts

U.S. tree nuts have strong market potential in Hong Kong, supported by a premium product reputation, trends in healthy eating, and re-export advantages. U.S. exports of tree nuts to Hong Kong fell from $1.2 billion in 2017 to $153.0 million in 2023, a decrease of 88 percent. Due to a lack of suitable climate and adequate agricultural space, Hong Kong is not able to support the production of certain tree nuts, and the entire domestic demand is supplied by imports. U.S. tree nuts, particularly almonds, walnuts, and pistachios, continue to be popular due to their health benefits and quality, especially among health-conscious younger consumers. People often consume tree nuts as convenient snacks or incorporate them into baked goods and meals as sources rich in protein, fiber, and healthy fats. Additionally, Hong Kong relies on imported almonds to re-export to mainland China and neighboring Asian markets. Euromonitor International expects U.S. tree nuts to remain popular among Hong Kong consumers because of their favorable brand image and wholesome reputation as a provider of safe and nutritious nuts.

Fresh Fruits

The United States exported $122.0 million of fresh fruits to Hong Kong in 2023, up 16 percent from $105.0 million in 2022, but down from its high of $291.0 million in 2017. Some of the largest U.S. fresh fruit exports were apples, blueberries, cherries, and citrus fruits. The market potential for U.S. fresh fruit exports to Hong Kong is robust, driven by consumer preferences for high-quality imports and health-conscious diets. Consumers highly regard U.S. apples, citrus fruits, cherries, grapes, and strawberries, among other fruits, for their quality, taste, and food safety standards. Health-conscious customers increasingly seek fresh fruits such as apples, citrus fruits, and berries that they perceive as natural sources of vitamins and antioxidants. Moreover, Hong Kong customers consume a high amount of daily fresh fruits in the forms of snacks, meals, and desserts. During seasonal periods and festivals, such as the Lunar New Year, U.S. fruits such as apples and grapes are considered special gifts. The market potential for U.S. fresh fruit exports will remain significant, supported by strong consumer demand, a high-quality reputation, and increasing health-conscious eating trends.

Condiments and Sauces

U.S. exports of condiments and sauces to Hong Kong grew from $10.7 million in 2022 to $11.8 million in 2023, a 10-percent increase. Hong Kong’s diverse culinary influences, strong consumer attraction for premium and international flavors, and health-conscious consumer base create strong demand for a wide range of sauces and condiments. U.S. condiments such as barbeque sauces, hot sauces, and specialty and gourmet marinades satisfy both Western and fusion cooking styles that are popular in Hong Kong and are known as premium products for quality and unique flavors. Healthier options with low sugar and sodium content also have growing appeal, while a cosmopolitan consumer base often prefers Western flavors. According to Euromonitor International, certain price-sensitive consumers prefer to eat at home and seek more convenient cooking solutions in the form of ready meals and soups that provide simple and efficient ways to prepare flavorful meals at home.

Candies/Confectioneries

U.S. exports of confectioneries to Hong Kong increased 78 percent by value from $3.3 million in 2022 to $5.8 million in 2023. The market demand for U.S. candy and confectionery products is strong, fueled by demand for premium sweets and consumers who are willing to spend on high-quality imported candies and chocolates. U.S. brands are well-known for quality and innovation, and they appeal to younger demographics and tourists. There is also growing demand for healthier confectionery options such as low-sugar and organic candies. U.S. companies are well positioned to benefit from this strong market.

Food Preparations

U.S. exports of food preparations to Hong Kong grew 7 percent by value from $146.0 million in 2022 to $156.0 million in 2023, driven by demand for high-quality, convenient, and healthy options. Hong Kong consumers, with busy lifestyles and limited time for meal preparation, increasingly seek food options that are ready-to-eat and easy to prepare. U.S. products such as soups, baking mixes, and meal kits, along with health-focused food preparations, have promising potential in this sector.

Seafood

Agricultural-related products, such as seafood, have favorable potential to expand in the Hong Kong market. Exports of U.S. seafood increased 13.5 percent from $127.0 million in 2022 to $144.0 million in 2023. Hong Kong was the sixth-largest market for U.S. seafood products in 2023. More than 99 percent of Hong Kong’s population is Chinese, and a traditional Chinese diet often prioritizes seafood. Hong Kong’s affluent consumers are willing to pay a premium price for quality seafood, and the return of tourists may ultimately increase seafood demand. Hong Kong also serves as a re-export hub for seafood, and its food import regulations are transparent and do not impose any trade barriers.

Trade Policy

Hong Kong is a founding member of the World Trade Organization (WTO) and a member of the Asia-Pacific Economic Cooperation. Hong Kong has eight free trade agreements with China, New Zealand, the European Free Trade Association, Chile, Macao, the Association of Southeast Asian Nations, Georgia, and Australia. Although Hong Kong is a Special Administrative Region of the People’s Republic of China, it is a separate customs territory and member of the WTO. Hong Kong has zero duties on nearly all food and beverage products and is free from tariffs and taxes while being a free port that allows for the free flow of goods and capital.

Conclusion

Despite sluggishness in economic growth caused by slow post-Covid recovery, Hong Kong presents additional growth opportunities for U.S. exporters as household incomes rise, consumer purchasing power and spending increase, and the tourism sector rebounds. Consumers continue to perceive U.S. agricultural products as high-quality, reliable, and safe. U.S. businesses should travel to Hong Kong to participate in trade missions and shows, collect industry-specific knowledge and intelligence, and build ties with domestic and regional importers.