Changing EU Oilseed Market Impacts Global Trade

Contact:

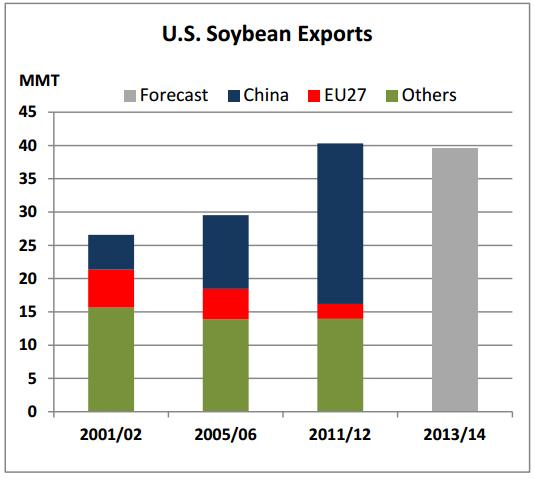

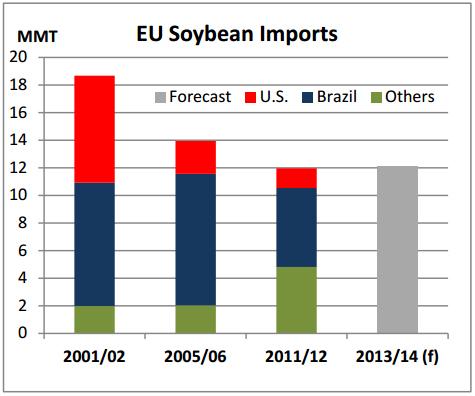

Ten years ago, the European Union was the world’s largest buyer of soybeans and the United States supplied nearly 40 percent of that market. Now, after regulatory and market changes, EU import demand has fallen substantially. However, there was little net impact of the trade loss on U.S. exports, as the U.S. industry adjusted to meet rising demand elsewhere in the world.

Longstanding Need for Imported Crops

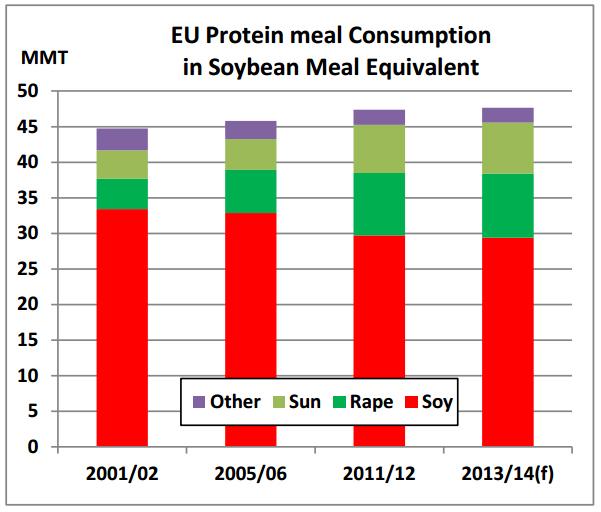

Among protein and grain deficit countries in the EU, imported oilseeds are essential for processing into meal as a protein ingredient in animal feed and as oil for food use. After disease outbreaks in the European cattle sector boosted demand for pork and poultry products, even more protein-rich compound feeds were required. The protein of choice was competitively priced, imported soybeans – primarily from the United States and Brazil. In the past few years, however, imports from other countries – mainly Canada, Paraguay and Ukraine – have expanded.

Market ChangesHave Stimulated Domestic Alternatives …

The 1992 Blair House Agreement (BHA), a memorandum of understanding between the United States and the EU, limited oilseed plantings to historical base areas, and compensated farmers with direct payments on oilseed production for food and feed.The agreement also limited oilseed production on set-aside land to the equivalent of one million tons of soybean meal, and this production could not be used for food or feed. Allotted set-aside land was promptly taken by France and Germany to plant rapeseed in order to kick-start their biodiesel programs. (Note: on a protein basis, one ton of soybean meal is equivalent to about 1.4 tons of rapeseed meal, which equates to 2.5 tons of rapeseed production). Then, in 2003, reform of the EU’s Common Agricultural Policy reduced oilseed payments to the same level as grains. According to the EU, that effectively rendered the BHA obligations obsolete, thereby lifting the limit on oilseed production.

…While Limiting U.S. Soybean Sales

The EU’s cautious approach to biotech crops remains in place with complex regulations and an onerous approval process. In 2009, the EU’s inability to approve a biotech soybean variety led to a halt in U.S. shipments. Labeling requirements for products originating from biotech soybeans have further eroded demand for U.S.sales. Ironically, stronger competition from Argentine soybean meal, crushed from EUapproved biotech varieties, will continue to displace U.S.soybean sales.

… Opening the Market to Competitors

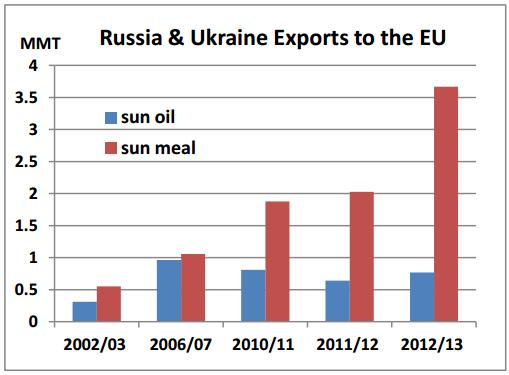

With falling EU soybean imports, Russia and Ukraine have greatly expanded production and processing of oilseeds with an eye towards exports to nearby markets like the EU. Production of sunflower seed has nearly tripled, while crushing has quadrupled. Exports of competitively priced sunflower seed meal to the EU have jumped sevenfold as a non-biotech protein source, partly displacing demand for soybean meal in the feed sector. Rising exports of sunflower seed oil have also benefitted from the opportunities in the food oil market, where rapeseed oil has been diverted to biodiesel use.

… and Freeing U.S.supplies for China

Although the EU’s importance has diminished for U.S.soybean exporters, China has emerged as a far larger market. Chinese imports have exploded, spurred by surging demand for protein feed in the livestock and aquaculture sectors, and an insatiable appetite for vegetable oil. With considerable investment in processing capacity, China’s crushing sector has become the largest in the world. Meanwhile, U.S. production growth has barely kept pace with surging import demand as evidenced by the tight stocks of the past several years. That will have to change if the United States is to maintain its share of an expanding global market for soybeans.