Browse Data and Analysis

Filter

Search Data and Analysis

- 10 results found

- (-) Tree Nuts

- (-) Beef & Beef Products

- Clear all

In 2023, Peru was the 28th-largest market for U.S. agricultural exports, valued at $851 million, making it the 3rd-largest market in South America. The U.S.-Peru Trade Promotion Agreement (PTPA) entered into force in February 2009, and U.S. agricultural exports reached $1 billion for the first time in 2014, peaking at $1.36 billion in 2018. The United States accounts for 14 percent of Peru's agricultural import market share, positioning it as the second-largest supplier to the country.

In 2023, Hong Kong was the 17th-largest market for U.S. agricultural products globally. That same year, the United States exported $1.5 billion of agricultural products and was the third-largest supplier of consumer-oriented food products to Hong Kong after China and Australia.

Since USDA first established a stand-alone mission area focusing on trade and international affairs in 2017, USDA’s Trade and Foreign Agricultural Affairs and the Foreign Agricultural Service have made significant trade policy advances to support U.S. agriculture. This series of commodity fact sheets highlights the many recent trade policy advances achieved by USDA.

In 2023, Morocco was the second-largest export market for U.S. agriculture on the African continent, importing over $610 million in U.S. agricultural products, accounting for over 16 percent of all U.S. exports to Africa. The United States has seen total exports quadruple and agricultural exports double since entering into a free-trade agreement (FTA) with Morocco in 2006.

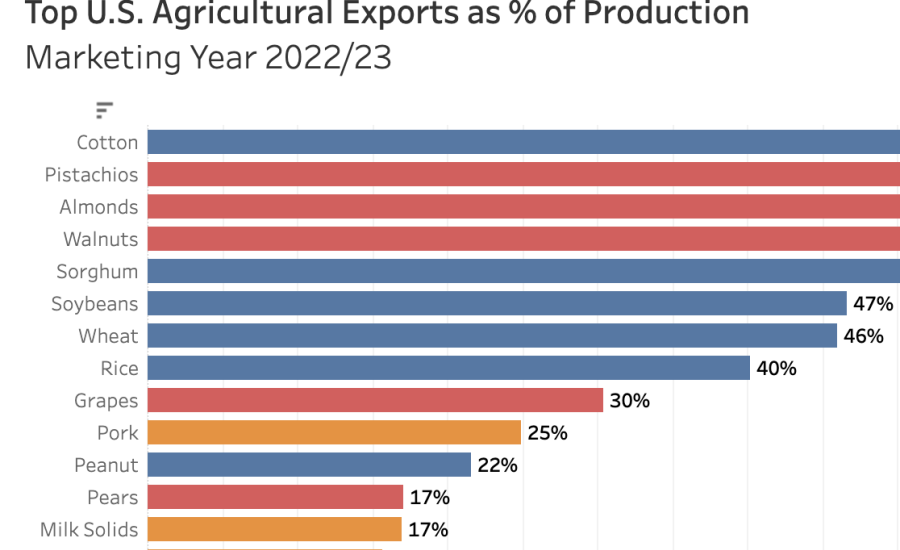

U.S. agricultural exports are a critical source of farm income. The USDA Economic Research Service estimates that on average 23 percent of the output of nonmanufactured agricultural products were exported between 2013 and 2022.

Vietnam offers abundant opportunities for exporting consumer-oriented products, despite the challenges of recovering from the COVID-19 pandemic and dealing with high inflation. The Vietnamese economy is poised for significant expansion in the coming decades. With a burgeoning population and a growing middle class, Vietnamese consumers are becoming more discerning about the origin and composition of their food.

Ample opportunities exist for U.S. agricultural exports to South Korea. Highlighted in the chart above, U.S. agricultural product exports were a record $9.5 billion in 2022, up 2 percent from 2021. South Korea is the sixth largest export market for the United States, thanks in part to a successful free trade agreement (KORUS) between the two countries and a robust demand for high-quality U.S. food products.

Japan has a well-developed food retail market that demands high-quality, high-value agricultural and food products. Despite reduced economic activity during the COVID-19 pandemic, trade data show that agricultural imports have remained resilient.

U.S. agricultural exports to China in fiscal year (FY) 2022 were $36.4 billion and surpassed the previous year’s record with China as the largest export market for the second consecutive year. Significantly higher agricultural prices and resilient demand helped drive exports above the previous year’s record despite lower volumes for most products.

Interactive Tableau visualization showing the percentage of exported agricultural production for 25 top commodities.