Tree Nuts 2019 Export Highlights

Top 10 Export Markets for U.S. Tree Nuts(values in million USD) |

|||||||

| Country | 2015 | 2016 | 2017 | 2018 | 2019 | % Change 2018-2019 |

5-Year Average 2015-2019 |

| European Union | 2,977 | 2,585 | 2,707 | 2,769 | 3,114 | 12% | 2,831 |

| India | 606 | 521 | 738 | 663 | 823 | 24% | 670 |

| Canada | 686 | 598 | 643 | 696 | 696 | 0% | 664 |

| Hong Kong | 846 | 1,156 | 1,251 | 1,052 | 692 | -34% | 999 |

| China | 208 | 182 | 243 | 328 | 606 | 85% | 314 |

| United Arab Emirates | 430 | 310 | 301 | 304 | 439 | 44% | 357 |

| Japan | 480 | 374 | 398 | 433 | 416 | -4% | 420 |

| Mexico | 269 | 253 | 256 | 371 | 344 | -7% | 299 |

| Turkey | 300 | 365 | 308 | 279 | 341 | 22% | 319 |

| South Korea | 354 | 296 | 305 | 290 | 290 | 0% | 307 |

| All Others | 1,285 | 1,261 | 1,329 | 1,331 | 1,314 | -1% | 1,304 |

| Total Exported | 8,441 | 7,902 | 8,479 | 8,514 | 9,075 | 7% | 8,482 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

In 2019, the value of U.S. tree nut exports to the world was $9.1 billion, a 7 percent increase over 2018. The top three markets, accounting for 51 percent of sales, were the EU, India, and Canada, at $3.1 billion, $823 million, and $696 million, respectively. While tree nut exports to Hong Kong, Japan, and Mexico declined by 34 percent, 4 percent, and 7 percent, respectively in 2019, this was more than offset by increases in sales to the EU, India, and China. Although almonds, pistachios, and walnuts all saw reduced output due to lower yields in 2019, almond and pistachio exports gained over the previous year. U.S. exports continue to dominate the global almond, pistachio, and walnut markets despite disruptions due to tariffs and restrictive phytosanitary requirements. The breakout of 2019 tree nut exports were 54 percent almonds ($4.9 billion), 22 percent pistachios ($2.0 billion), 14 percent walnuts ($1.3 billion), 5 percent pecans ($475 million), 4 percent ‘mixed & other nuts’ ($350 million), and 1 percent hazelnuts ($90 million).

Drivers

-

Exports to Hong Kong and Vietnam fell due to China’s tightening of import controls on the re-sale of U.S. tree nuts.

-

Strong demand drove exports to China up $278 million in 2019, despite retaliatory tariffs of 40 percent.

-

Exports to India rebounded 24 percent, or $160 million in 2019 (record year), despite implementation of retaliatory tariffs for almonds and walnuts.

-

Tree nut exports to EU increased 12 percent in part due to pre-departure inspection programs put into place.

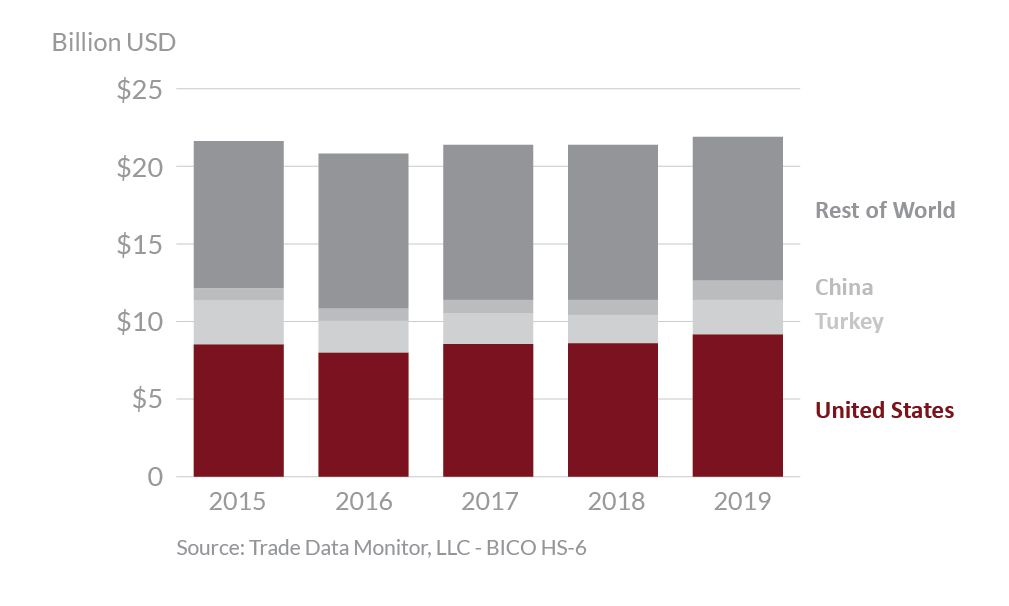

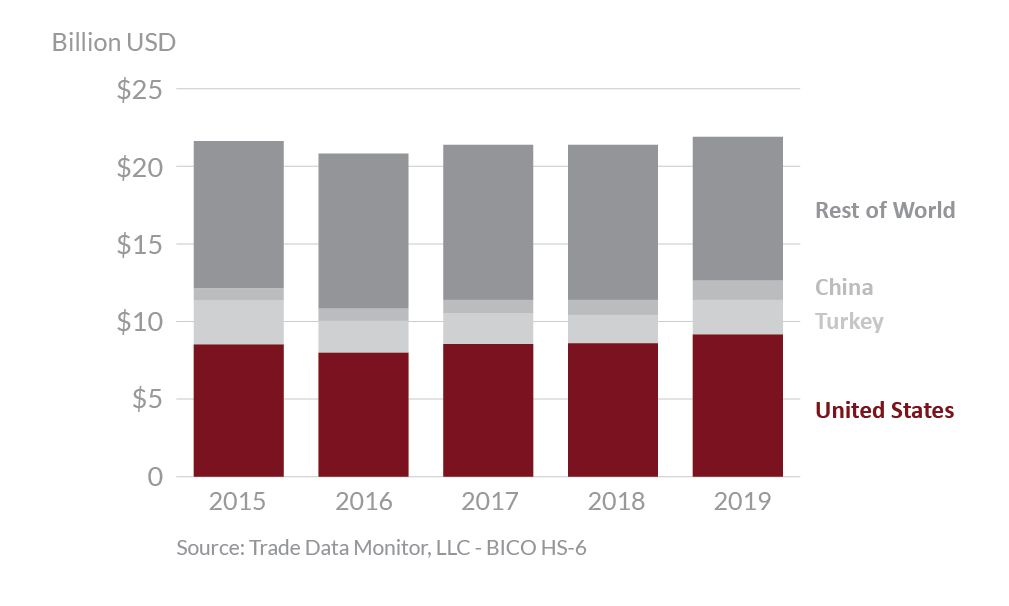

Global Tree Nut Exports

Moving forward, the United States is likely to maintain its near 80 percent share of world almond production and trade, with limited competition from Australia. The U.S. walnut industry commands over half of world trade, with modest competition from Ukraine, where limited expansion is foreseen. Although China produces over 40 percent of the world’s walnuts, their exports account for less than 5 percent of world trade due to variety preferences and strong domestic demand. The U.S. pistachio industry will likely remain in close competition with Iran to be the world’s leading producer and exporter, often trading places depending on conditions affecting yield. New market opportunities for U.S. tree nut exports include countries in Central and South America. The United States has competitive advantages in tree nut production and exports, with 10-year growth averaging 7 percent annually and is well-positioned to maintain its global dominance. Some issues affecting future sales include compliance with pesticide maximum residue levels (MRLs) which has increasingly presented exporters with challenges selling to the EU. The United States continues to advocate systems that comply with science-based WTO guidelines. U.S. tree nut producers also face concern over Japan’s stringent enforcement and testing protocol for aflatoxins which lead to 100 percent monitoring on U.S. shipments. The COVID-19 pandemic may affect the global demand for tree nuts as global spending slows, people stay home and eat out less.