Taiwan 2021 Export Highlights

Top 10 U.S. Agricultural Exports to Taiwan(values in million USD) |

|||||||

| Commodity | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| Soybeans | 586 | 854 | 691 | 606 | 736 | 21% | 695 |

| Beef & Beef Products | 409 | 552 | 568 | 552 | 668 | 21% | 550 |

| Corn | 395 | 603 | 232 | 178 | 435 | 144% | 368 |

| Wheat | 295 | 267 | 324 | 309 | 304 | -2% | 300 |

| Fresh Fruit | 218 | 199 | 252 | 196 | 208 | 6% | 214 |

| Food Preparations | 140 | 145 | 140 | 132 | 194 | 47% | 150 |

| Poultry Meat & Products* | 152 | 189 | 187 | 223 | 167 | -25% | 184 |

| Dairy Products | 83 | 93 | 109 | 121 | 140 | 15% | 109 |

| Non-Alcoholic Beverages** | 63 | 64 | 79 | 81 | 83 | 3% | 74 |

| Tree Nuts | 111 | 85 | 90 | 67 | 78 | 15% | 86 |

| All Others | 880 | 913 | 905 | 809 | 854 | 6% | 872 |

| Total Exported | 3,332 | 3,964 | 3,577 | 3,274 | 3,867 | 18% | 3,603 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

*Excludes eggs

**Excludes juices

Highlights

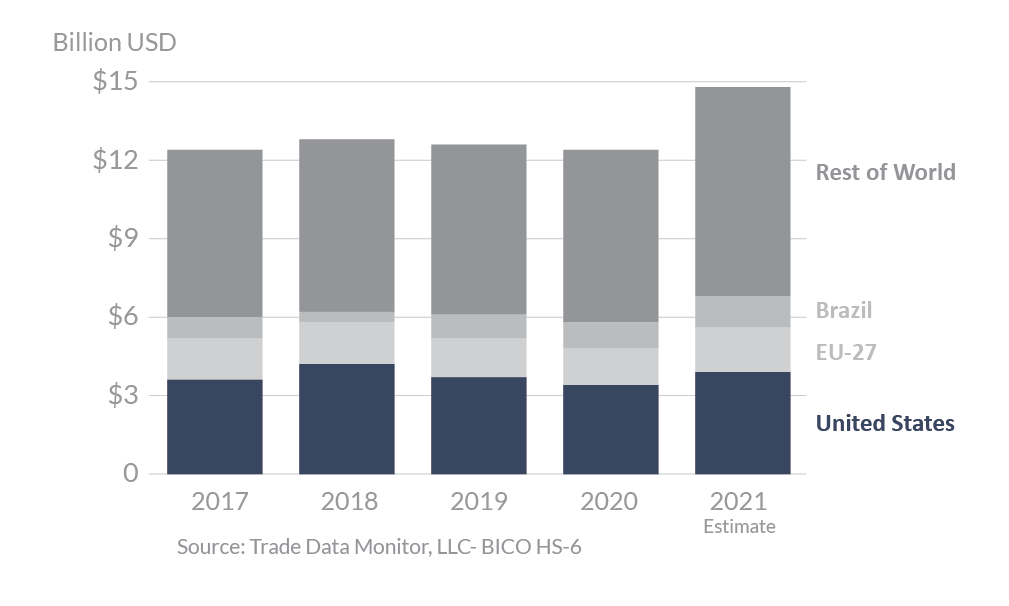

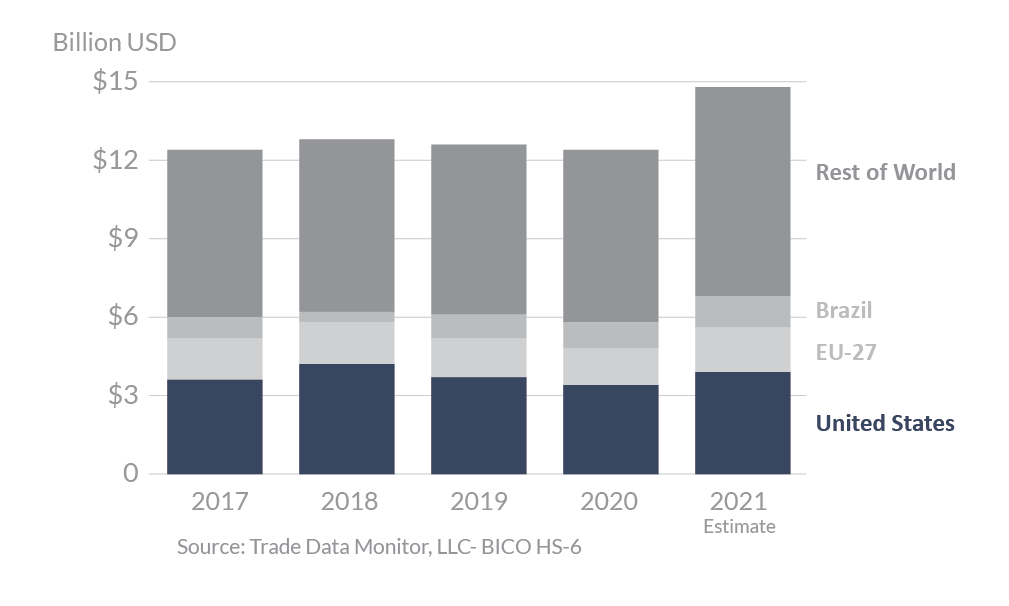

In 2021, Taiwan was the seventh-largest destination for U.S. agricultural exports, totaling $3.9 billion, an 18-percent increase from 2020. The United States is Taiwan’s top supplier of agricultural goods with a 27-percent market share, followed by the EU27 with 16 percent. Corn had the largest export growth in 2021, as reduced competition from Brazil and higher prices helped boost U.S. export values. Higher prices also helped raise export values of soybeans and beef and beef products. Following a record year in 2020, Taiwan’s poultry meat imports from the world shrank in 2021 due to high international prices, a slight expansion in domestic production, and logistical constraints. As the largest poultry supplier to Taiwan, the United States bore the brunt of the impact.

Drivers

- Higher prices helped boost U.S. export values of corn, soybeans, and beef and beef products.1 In the case of corn, reduced competition also contributed to larger U.S. sales.

- U.S. poultry meat and product exports declined in 2021, as Taiwan’s overall demand for poultry meat contracted.

- Taiwan’s developed economy, relatively high per-capita income, and deepening ties with the United States continue to make it an important agricultural export market for U.S. producers.

- In order to stabilize high domestic prices, Taiwan temporarily lowered tariffs on beef and wheat, which encouraged imports.

- U.S. pork exports to Taiwan decreased because of certain regulatory actions implemented on January 1, 2021, including country of origin labeling measures, that negatively affected the market.

Taiwan’s Agricultural Suppliers

Looking Ahead

Taiwan’s successful response to the coronavirus pandemic resulted in extremely low levels of virus transmission, setting the stage for economic growth as global demand recovers. Surplus disposable income (diverted in part from lost travel opportunities), increasing culinary awareness, and demand for apparent “luxury” products provide continued opportunities to U.S. exporters in higher value agricultural commodities and consumer-oriented food products including dairy (ice cream, yogurt), confectionary (chocolate), and alcohol (wine, spirits). U.S. agricultural exports will remain strong. Further, efforts to stabilize commodity prices and lessen the burden on consumer food purchases, such as waiving business taxes and import tariffs until April 30, 2022, have encouraged imports.

1 Effective Jan 1, 2021, Taiwan eliminated the requirement that beef be sourced from cattle less than 30 months of age.