Rice 2019 Export Highlights

Top 10 Export Markets for U.S. Rice(values in million USD) |

|||||||

| Country | 2015 | 2016 | 2017 | 2018 | 2019 | % Change 2018-2019 |

5-Year Average 2015-2019 |

| Japan | 278 | 234 | 190 | 232 | 275 | 19% | 242 |

| Mexico | 284 | 267 | 292 | 268 | 275 | 3% | 277 |

| Haiti | 189 | 190 | 237 | 206 | 207 | 0% | 206 |

| Canada | 160 | 148 | 148 | 175 | 194 | 11% | 165 |

| South Korea | 133 | 105 | 86 | 89 | 135 | 52% | 110 |

| Saudi Arabia | 87 | 93 | 88 | 73 | 97 | 32% | 88 |

| Jordan | 82 | 73 | 90 | 66 | 76 | 16% | 77 |

| Iraq | 53 | 43 | 19 | 89 | 72 | -19% | 55 |

| Colombia | 140 | 58 | 52 | 54 | 49 | -10% | 71 |

| Honduras | 60 | 71 | 45 | 61 | 47 | -23% | 57 |

| All Others | 525 | 502 | 463 | 365 | 436 | 19% | 458 |

| Total Exported | 1,990 | 1,784 | 1,709 | 1,678 | 1,862 | 11% | 1,805 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

In 2019, the value of U.S. rice exports to the world reached $1.9 billion, up 11 percent from the prior year. The top three markets, accounting for 41 percent of exports, were Japan, Mexico, and Haiti at $275 million, $275 million, and $207 million, respectively. Mexico accounted for 23 percent by volume, primarily a paddy (rough) rice market. Free trade agreement regions remained significant markets, particularly in the Western Hemisphere.

Drivers

-

2019 saw strong growth in exports to countries where the United States has free trade agreements, including Mexico, Canada, the CAFTA-DR countries, and Panama.

-

Mexico continued as the top market and exports there expanded in 2019, particularly for paddy rice, with less competition from South American suppliers.

-

Among CAFTA-DR countries, Honduras and Guatemala remained strong buyers and shipments to Nicaragua rebounded to levels not seen in a decade.

-

Commercial export volumes to Haiti expanded amid more favorable prices.

-

Medium-grain exports to Japan, South Korea, Taiwan, Saudi Arabia, and Jordan expanded both in terms of volume as well as value, with reduced competition from Australia amid its severe drought.

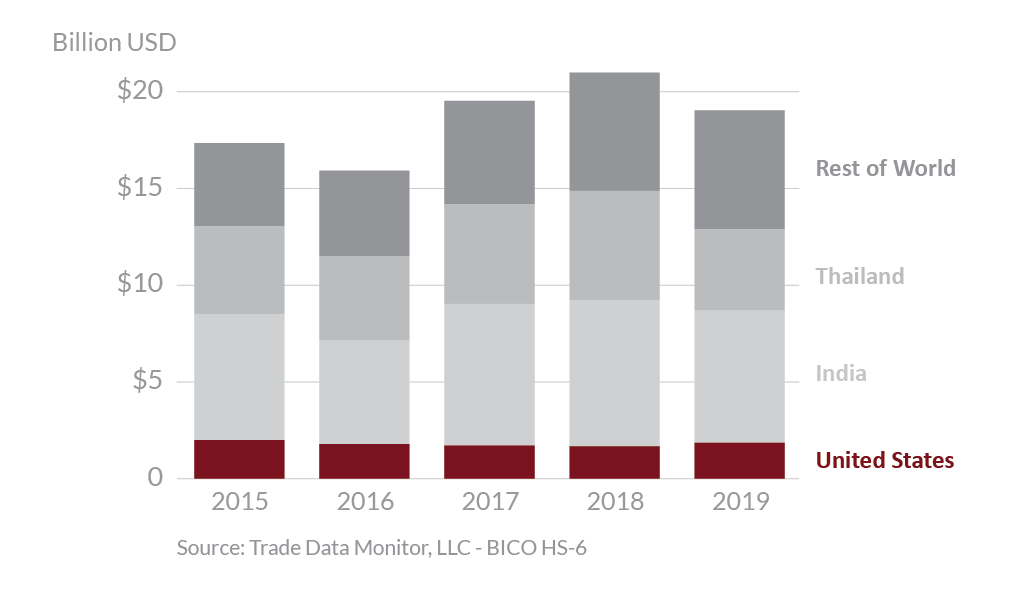

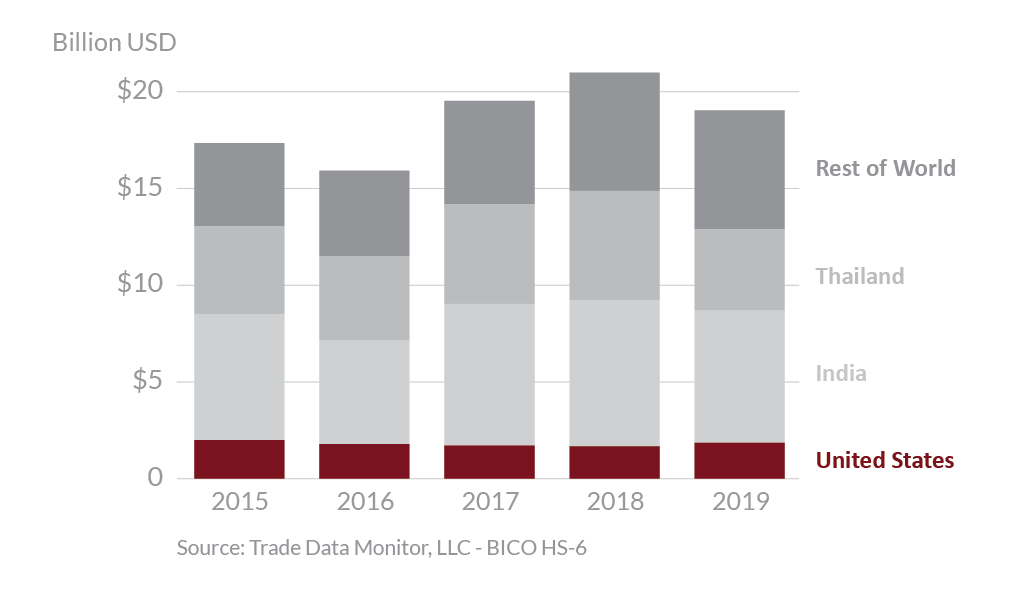

Global Rice Exports

Prior to the COVID-19 outbreak, 2020 exports of rice were forecast 4 percent higher and are expected to account for around half of domestic production. More rice planted area is expected in the United States in 2020/21, resulting in larger expected exportable supplies. Demand for U.S. rice is expected to remain strong among core markets such as Mexico and Haiti. The outlook is favorable for maintaining a strong market presence in countries with Free Trade Agreements such as Colombia, Central America, and the Dominican Republic. However, competition from South American suppliers is expected to remain fierce for Western Hemisphere markets and Iraq. U.S. prices remain high relative to Asian prices, making it challenging to compete in price-sensitive markets such as Africa and Southeast Asia. While Thai prices are rising amid tighter supplies, Chinese export prices remain particularly low, and India and Vietnam remain formidable competitors. The COVID-19 outbreak will likely interject uncertainty into U.S. rice forecasts by affecting global demand as well as potential export restrictions by competitor producer and exporter nations.