Pork 2019 Export Highlights

Top 10 Export Markets for U.S. Pork(values in million USD) |

|||||||

| Country | 2015 | 2016 | 2017 | 2018 | 2019 | % Change 2018-2019 |

5-Year Average 2015-2019 |

| Japan | 1,565 | 1,553 | 1,626 | 1,631 | 1,523 | -7% | 1,580 |

| China | 427 | 713 | 662 | 571 | 1,300 | 128% | 735 |

| Mexico | 1,268 | 1,360 | 1,514 | 1,311 | 1,278 | -2% | 1,346 |

| Canada | 778 | 798 | 793 | 765 | 802 | 5% | 787 |

| South Korea | 472 | 364 | 475 | 670 | 593 | -12% | 515 |

| Australia | 173 | 178 | 208 | 227 | 302 | 33% | 218 |

| Colombia | 102 | 105 | 163 | 215 | 222 | 3% | 161 |

| Hong Kong | 282 | 360 | 415 | 282 | 154 | -45% | 299 |

| Chile | 41 | 54 | 85 | 91 | 123 | 35% | 79 |

| Philippines | 80 | 79 | 98 | 116 | 93 | -20% | 93 |

| All Others | 379 | 373 | 446 | 524 | 562 | 7% | 457 |

| Total Exported | 5,567 | 5,936 | 6,485 | 6,403 | 6,952 | 9% | 6,269 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

In 2019, the value of U.S. pork and pork product exports to the world reached a record $7.0 billion, up 9 percent from the prior year. The top three markets, accounting for 59 percent of exports, were Japan, China, and Mexico at $1.5 billion, $1.3 billion, and $1.3 billion, respectively. Exports to China more than doubled as production impacts from ASF buoyed demand for imported pork. Japan remained the top market by value, but higher competition from other suppliers led to a 7-percent decline from last year. Exports to Mexico also fell, as retaliatory tariffs stifled trade during the first half of the year. Despite the repeal of retaliatory tariffs in May 2019, a weak economy and strong gains in domestic production hampered demand for U.S. pork.

Drivers

-

China emerged as the second-largest market for U.S. pork in 2019, generating an additional $700 million in exports over the previous year, due to decreased Chinese production resulting from an African Swine Fever outbreak.

-

Australia was a bright spot for U.S. pork with the U.S. export value rising by one-third to $300 million. Competitive prices and strong demand for processing boosted shipments.

-

Exports to top market Japan declined $100 million as U.S. pork faced strong competition from EU and Canadian pork.

-

Rising consumer demand propelled exports to Central America, including double-digit growth to Costa Rica, Guatemala, Honduras, Nicaragua, and Panama.

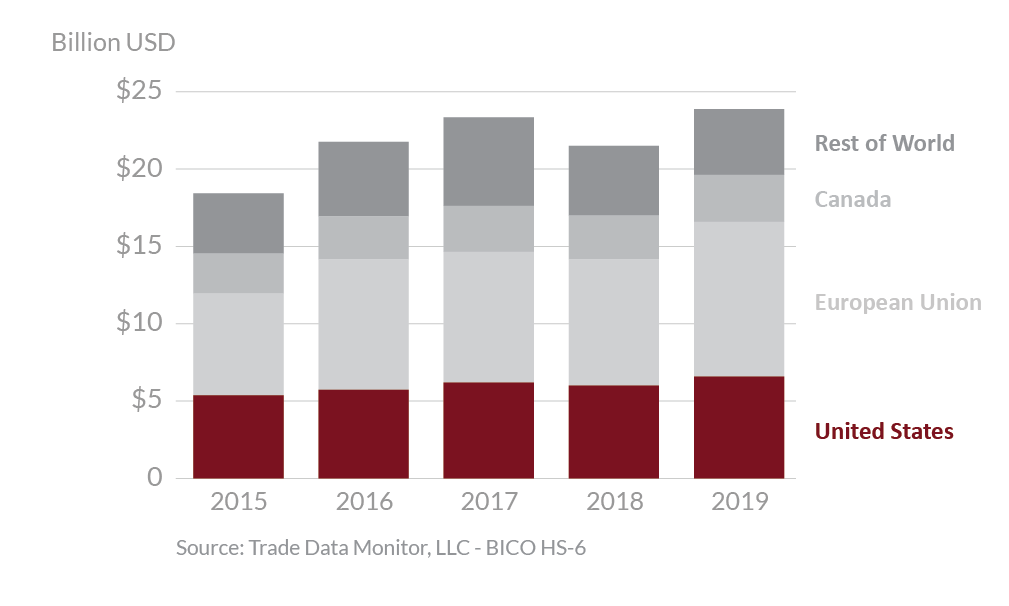

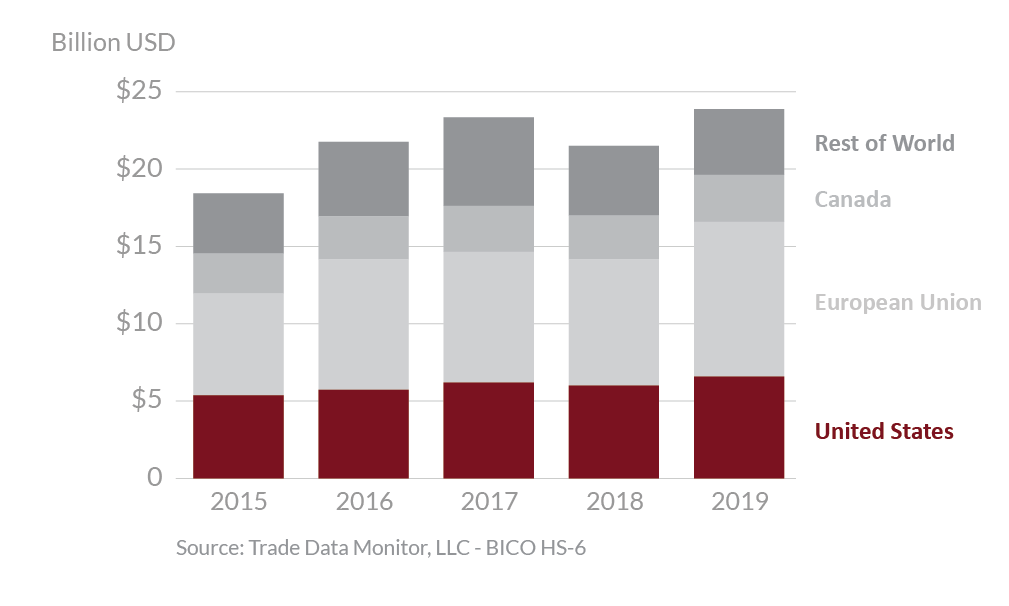

Global Fresh Pork Exports

2020 exports of pork are forecast higher by volume on strong global demand. Robust growth in U.S. pork production will boost exportable supplies and exports will climb to a record 26 percent of domestic production. ASF will continue to be a major driver, with production shortfalls in China, the Philippines, and Vietnam propelling growth in pork trade. Despite retaliatory tariffs, U.S. pork is expected to make major gains to China, buoyed by implementation of the Phase One Agreement although impacts from coronavirus remain a risk factor. Exports to Japan are also expected to rise due to tariff reductions included in the U.S.- Japan Trade Agreement: beginning January 1, 2020, tariffs on U.S. pork are lowered to the same levels as those for Canada and the European Union. The COVID-19 outbreak injects uncertainty into the equation as closures of meat packing plants may affect the value and volume of pork supplies available for export.