Philippines 2021 Export Highlights

Top 10 U.S. Agricultural Exports to Philippines(values in million USD) |

|||||||

| Commodity | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| Soybean Meal | 747 | 884 | 788 | 900 | 960 | 7% | 856 |

| Wheat | 555 | 642 | 708 | 827 | 871 | 5% | 721 |

| Dairy Products | 242 | 247 | 273 | 409 | 437 | 7% | 322 |

| Pork & Pork Products | 98 | 116 | 93 | 114 | 204 | 78% | 125 |

| Poultry Meat & Products* | 92 | 111 | 102 | 64 | 147 | 130% | 103 |

| Food Preparations | 74 | 86 | 91 | 109 | 110 | 1% | 94 |

| Processed Vegetables | 96 | 102 | 129 | 74 | 97 | 32% | 100 |

| Feeds, Meals & Fodders | 51 | 73 | 67 | 75 | 86 | 14% | 71 |

| Beef & Beef Products | 62 | 87 | 88 | 62 | 74 | 19% | 74 |

| Soybeans | 92 | 66 | 52 | 54 | 65 | 19% | 66 |

| All Others | 569 | 668 | 606 | 522 | 498 | -5% | 573 |

| Total Exported | 2,678 | 3,083 | 2,996 | 3,210 | 3,549 | 11% | 3,103 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

*Excludes eggs

Highlights

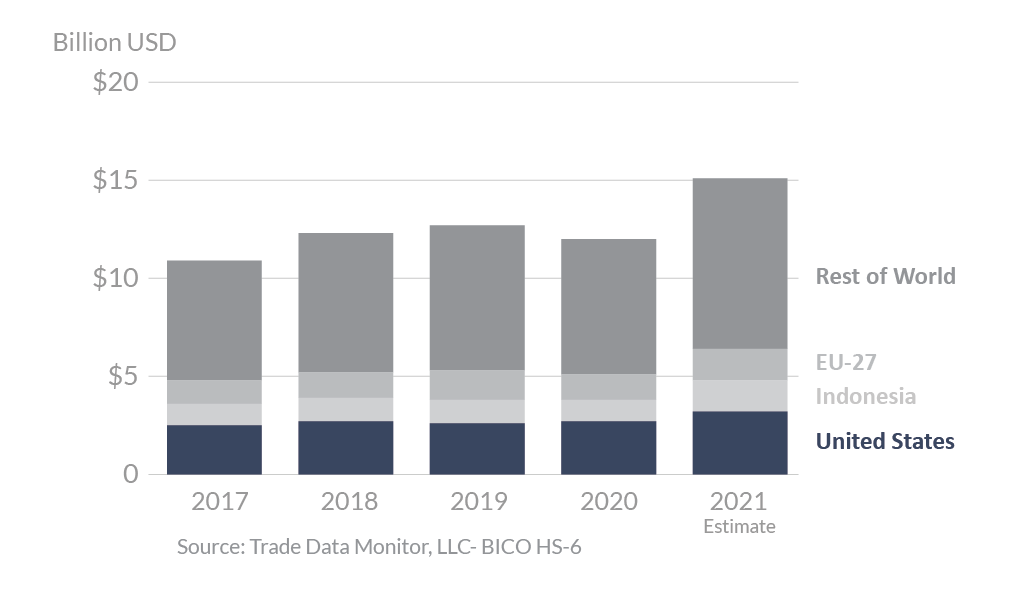

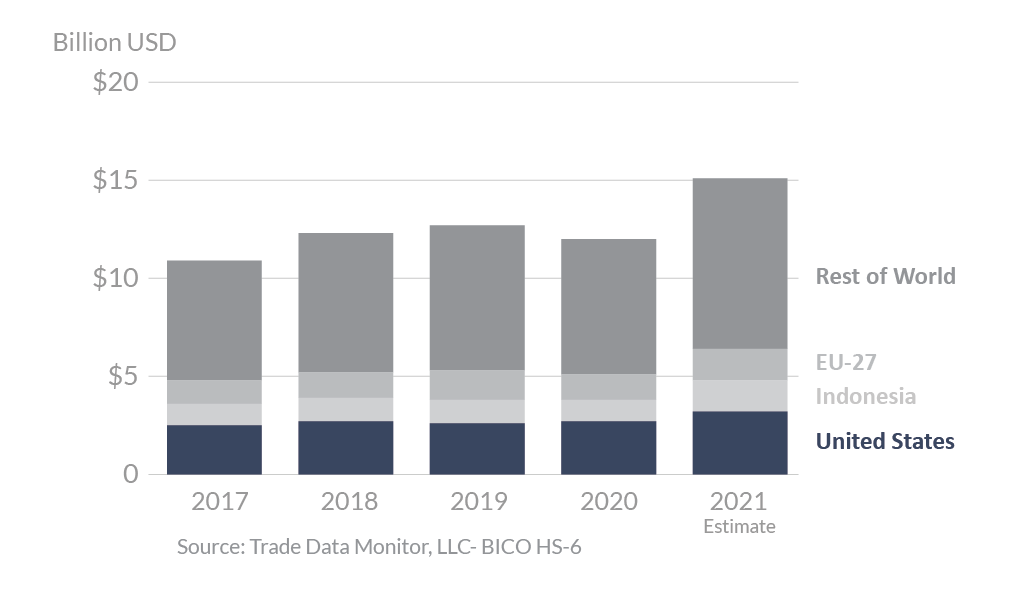

In 2021, the Philippines was the eighth-largest export destination for U.S. products, accounting for more than $3.5 billion, an 11-percent increase over 2020. The United States is the Philippines’ top supplier of agricultural goods, supplying an estimated 21 percent of the total import market by value. The EU, the second-largest supplier, has an 11-percent market share. The largest year-to-year export increase was seen in pork and pork products, with a $90 million (79 percent) increase over last year. U.S. exports of poultry meat and products, soybean meal, and wheat also performed well, increasing by $83 million, $60 million, and $44 million respectively. None of the top U.S. exports to the Philippines declined in 2021. The Philippines was the largest export destination for U.S. soybean meal, second largest for wheat, fourth largest for dairy products, and seventh largest for pork.

Drivers

- Coming out of the COVID-19 pandemic and economic recession, the Philippines rebounded from its 2020 GDP decline of 9.4 percent with a projected 5.0 percent GDP growth in 2021, which contributed to increased levels of food and agricultural imports.

- Exports of most major agricultural products to the Philippines increased in 2021. Some products such as poultry, beef, and processed vegetables have bounced back from a slow 2020, while others like wheat, dairy products, and food preparations have been consistently rising annually.

- ASF’s continued decimation of local pork production, inflationary pressures accompanied by a spending rebound, and an on-again-off-again opening of the economy were key drivers in 2021.

Philippines’s Agricultural Suppliers

Looking Ahead

With a total population of 110 million, the Philippines remains a young, fast-growing, and highly urbanized market, although the economy remains a laggard in the region with respect to COVID recovery. A traditionally strong preference for U.S. food and beverage products continues to offer strong potential for growth despite continuous erosion of U.S. market share in favor of trade partners with preferential tariff treatment (e.g., Australia and China).

The United States can expect tariff increases on key products in 2022. On May 18, 2022, most favored nation (MFN) tariff rates for in-quota and out-quota pork imports are set to increase from 15 to 30 percent and 25 to 40 percent respectively. Starting February 1, 2022, the annual in-quota volume reverted to 54,210 metric tons from the temporary expansion to 254,210 metric tons in mid-2021. On January 1, 2023, the temporary reduced MFN tariff of 5 percent on mechanically deboned chicken meat reverts to 40 percent.