Mexico 2019 Export Highlights

Top 10 U.S. Agricultural Exports to Mexico(values in million USD) |

|||||||

| Commodity | 2015 | 2016 | 2017 | 2018 | 2019 | % Change 2018-2019 |

5-Year Average 2015-2019 |

| Corn | 2,302 | 2,550 | 2,646 | 3,061 | 2,719 | -11% | 2,655 |

| Soybeans | 1,432 | 1,462 | 1,574 | 1,822 | 1,867 | 2% | 1,632 |

| Dairy Products | 1,280 | 1,218 | 1,312 | 1,398 | 1,546 | 11% | 1,351 |

| Pork & Pork Products | 1,268 | 1,360 | 1,514 | 1,311 | 1,278 | -2% | 1,346 |

| Beef & Beef Products | 1,093 | 977 | 979 | 1,058 | 1,107 | 5% | 1,043 |

| Poultry Meat & Products* | 1,029 | 932 | 933 | 956 | 1,077 | 13% | 985 |

| Wheat | 651 | 612 | 852 | 662 | 812 | 23% | 718 |

| Prepared Food | 705 | 710 | 679 | 743 | 777 | 5% | 723 |

| Soybean Meal | 800 | 801 | 579 | 665 | 642 | -3% | 697 |

| Fresh Fruit | 560 | 501 | 570 | 619 | 610 | -1% | 572 |

| All Other | 6,575 | 6,706 | 6,961 | 6,801 | 6,721 | -1% | 6,753 |

| Total Exported | 17,695 | 17,827 | 18,598 | 19,096 | 19,156 | 0% | 18,474 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

*Excludes eggs

Highlights

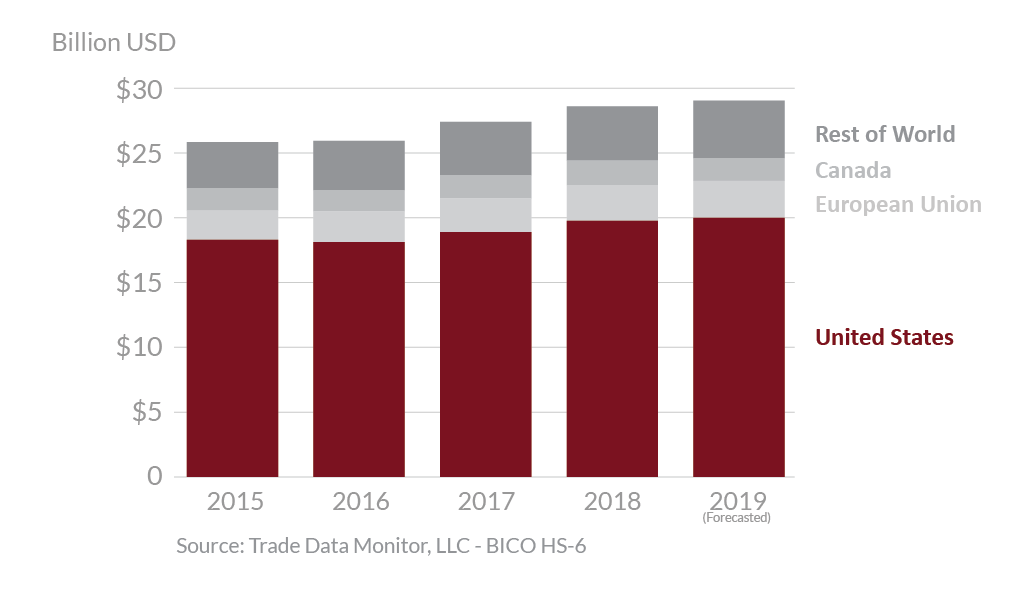

In 2019, Mexico was the second largest destination for U.S. agricultural exports, which totaled $19.2 billion, a less than one percent increase from 2018. The United States is the largest supplier of agricultural goods to Mexico, holding a 69 percent market share. The largest export growth was seen in wheat and dairy products, up $150 million and $148 million, respectively. Additionally, exports of poultry meat & products (excluding eggs), coarse grains (excluding corn), and fresh vegetables were up $121 million, $93 million, and $61 million, respectively. Exports of corn were down by $342 million. Exports of wine & beer, cotton, and sugar & sweeteners were down $101 million, $84 million, and $48 million, respectively. For 2019, Mexico was the top market for U.S. corn, wheat, dairy products, poultry meat & products, distiller grains, rice, sweeteners, animal fats, and eggs & products.

Drivers

-

Mexico’s growing population and expanding economy fuels a growing demand for milk and milk products which is outpacing domestic production. The United States is the main supplier of dairy products to Mexico.

-

Mexico relies heavily on imports of U.S. pork products to satisfy increasing demand for lower-cost protein. In 2019, retaliatory tariffs on U.S. pork during the first half of the year and higher domestic pork production reduced demand for imports.

-

Mexican poultry consumption is growing as a result of increasing demand for lower-cost protein. Increased competition from Brazil has cut into the U.S. market share.

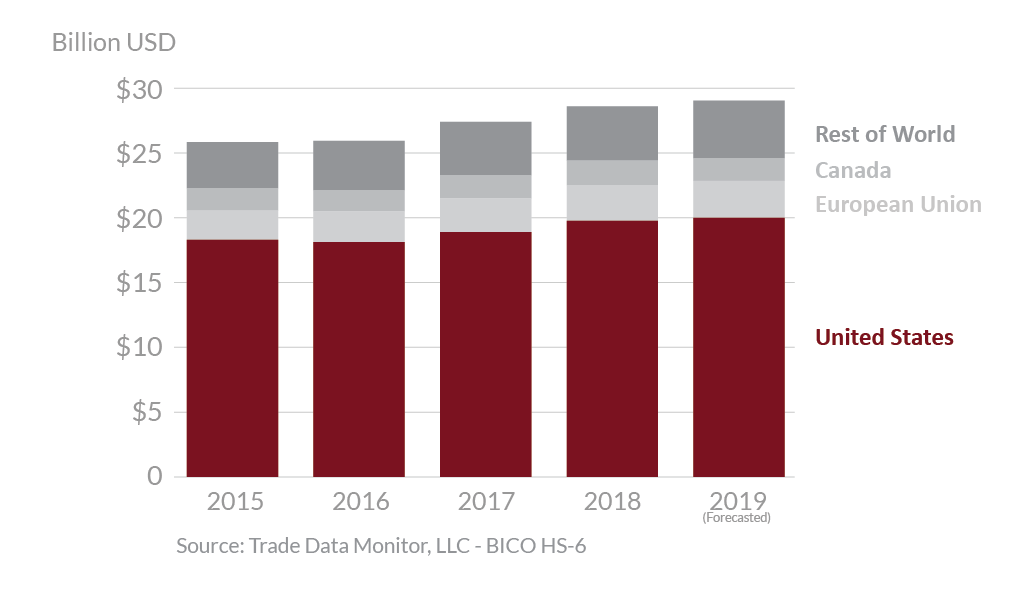

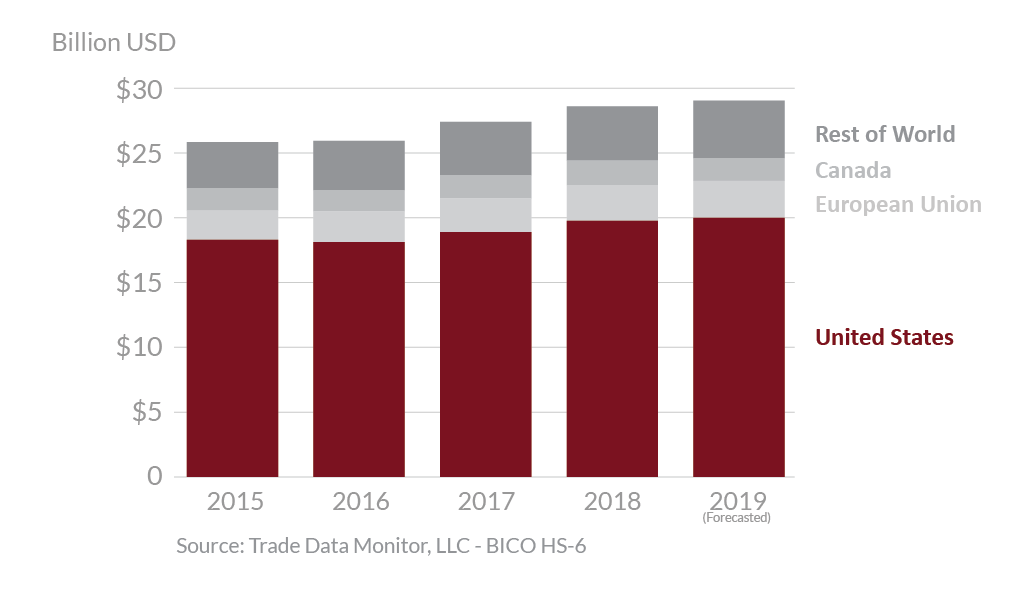

Mexico's Agricultural Suppliers

Looking Ahead

The outlook for U.S. agricultural exports to Mexico in 2020 remains positive and producers of products affected by the previous retaliatory tariffs are hopeful that market stability will continue. U.S. exporters already enjoy tariff-free access to Mexico, but implementation of the United States-Mexico-Canada Agreement (USMCA) solidifies stability to U.S.-Mexico trade and ensures continued access to goods and products for both countries. The USMCA contains new and enforceable rules to ensure that SPS measures are science-based, developed, and implemented in a transparent and non-discriminatory manner; have provisions to prevent technical barriers to trade in wine and distilled spirits; and have requirements regarding protection of the confidentiality of information relating to companies’ proprietary formulas. Further, Mexico committed not to restrict market access of U.S. cheese products by listing individual cheese names.

USDA will continue working to expand market access for U.S. potatoes, which are currently blocked by Mexican potato industry lawsuits that are before the Mexican Supreme Court, and advocate for science-based policies on biotechnology approvals and pesticides, and increased allowances for ethanol blending.