Hong Kong 2019 Export Highlights

Top 10 U.S. Agricultural Exports to Hong Kong(values in million USD) |

|||||||

| Commodity | 2015 | 2016 | 2017 | 2018 | 2019 | % Change 2018-2019 |

5-Year Average 2015-2019 |

| Beef & Beef Products | 801 | 684 | 884 | 966 | 744 | -23% | 816 |

| Tree Nuts | 846 | 1,156 | 1,251 | 1,052 | 692 | -34% | 999 |

| Poultry Meat & Products* | 408 | 426 | 469 | 431 | 354 | -18% | 418 |

| Fresh Fruit | 288 | 281 | 291 | 237 | 195 | -18% | 258 |

| Prepared Food | 137 | 232 | 169 | 228 | 191 | -16% | 191 |

| Pork & Pork Products | 282 | 360 | 415 | 282 | 154 | -45% | 299 |

| Wine & Beer | 99 | 101 | 120 | 131 | 114 | -13% | 113 |

| Dog & Cat Food | 36 | 40 | 50 | 62 | 57 | -8% | 49 |

| Processed Vegetables | 51 | 54 | 49 | 53 | 54 | 2% | 52 |

| Eggs & Products | 33 | 39 | 38 | 46 | 46 | 0% | 41 |

| All Other | 604 | 458 | 477 | 475 | 390 | -18% | 481 |

| Total Exported | 3,582 | 3,832 | 4,213 | 3,961 | 2,991 | -24% | 3,716 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

*Excludes eggs

Highlights

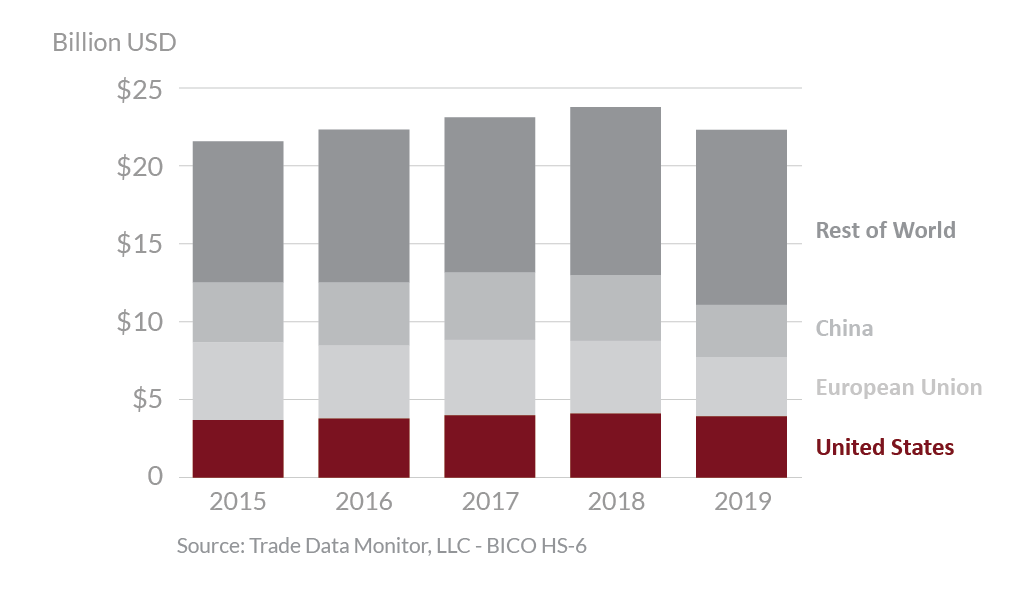

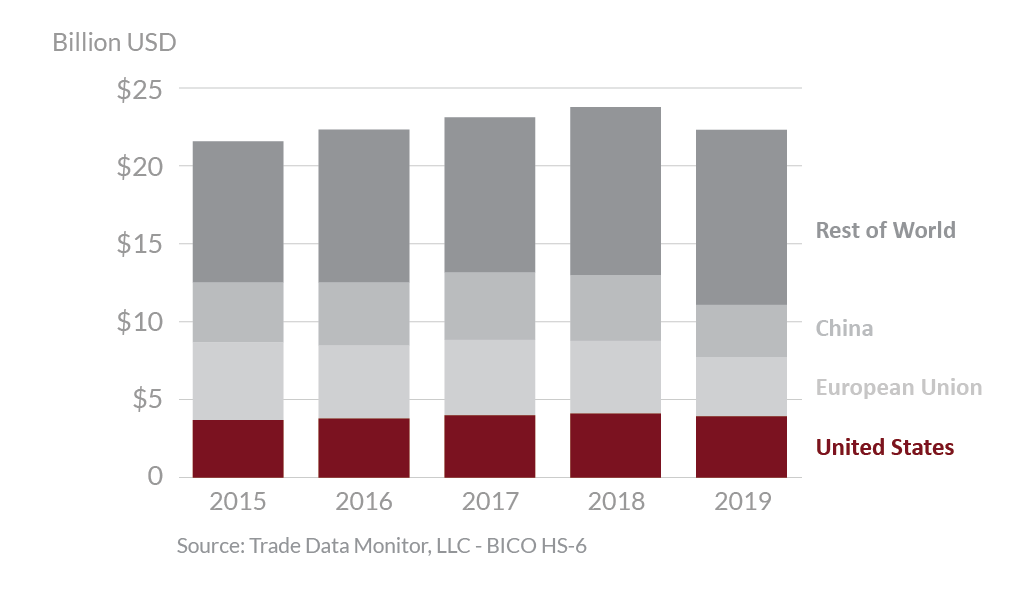

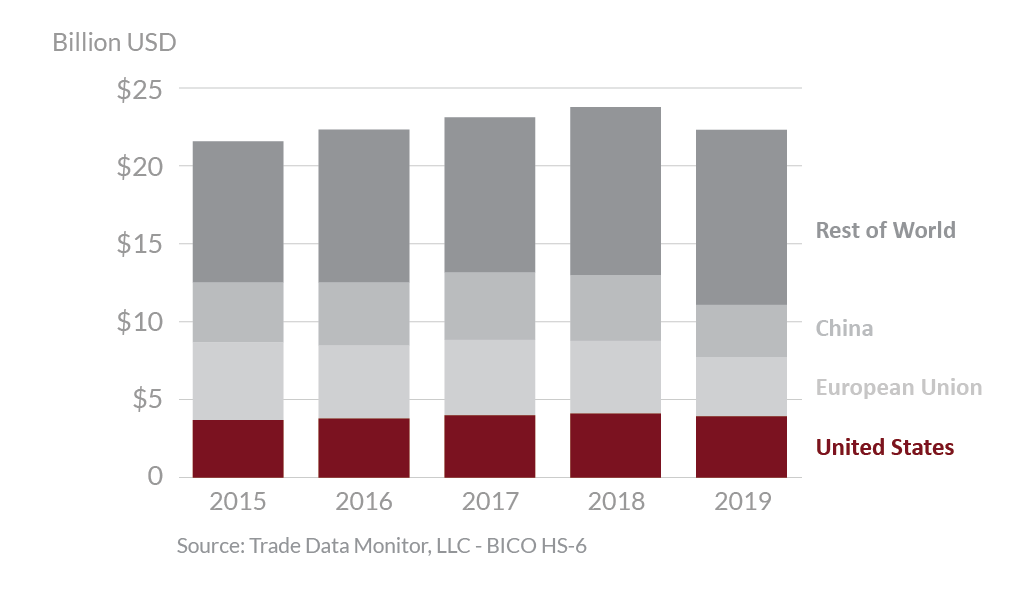

In 2019, Hong Kong was the ninth-largest destination for U.S. food and agricultural exports, which totaled $3.0 billion, a 24 percent decrease from 2018. The United States was the second- largest supplier of agricultural goods with 15 percent market share behind Mainland China at 20 percent. This downward import trend was due to uncertainties from the 2019 trade dispute between the U.S. and China and slowing domestic consumption due to an aging population and slowing economic growth. Among the few products that saw export growth in 2019 include meat products (guts, bladders, stomachs) and cotton, up $7 million and $4 million, respectively. Additionally, increases in exports of U.S. rice, processed vegetables, and snack foods were up $2 million, $1 million, and $1 million, respectively. Exports of tree nuts were down by more than $359 million. Exports of beef and beef products, pork and pork products, and poultry meat and products (excluding eggs) were down $222 million, $127 million, and $78 million, respectively.

Drivers

-

Beginning in June 2019, Hong Kong experienced historic social unrest which led to an economic recession that was particularly severe in the food and hospitality sector.

-

Hong Kong is a major metropolis of 7.4 million people with one of the highest incomes per capita in Asia and is visited by millions of tourists and business travelers every year. With limited land resources, Hong Kong imports 95 percent of its food supply. As a result, Hong Kong maintains a food import regulatory system with zero import duties on all food and agricultural products except spirits and tobacco.

-

The U.S.–China trade dispute impacted Hong Kong imports given that it acts as a port of entry for some products being transshipped to China and as a processing and distribution center for other products heading to China. Much of this trade through Hong Kong was stopped as China restricted imports from the United States.

Hong Kong's Agricultural Suppliers

Looking Ahead

With the United States and China signing the Phase One Trade Agreement, the transshipment of goods through Hong Kong and destined for China should resume. Another year of significant uncertainty for Hong Kong is expected in 2020 if social unrest continues and fears of the COVID-19 outbreak restrict economic activity. The outbreak of COVID-19 centered in Wuhan, China poses a substantial economic challenge to markets across East Asia and the world. In response, Hong Kong’s government has announced unprecedented economic stimulus measures to soften the blow, and ideally, restart the city’s economy. Hong Kong residents will receive government assistance and record-setting amounts of resources will be allocated to entice trade show visitors, travelers, and residents alike to generate economic activity and rebuild Hong Kong’s economy and reputation.