Canada 2019 Export Highlights

Top 10 U.S. Agricultural Exports to Canada(values in million USD) |

|||||||

| Commodity | 2015 | 2016 | 2017 | 2018 | 2019 | % Change 2018-2019 |

5-Year Average 2015-2019 |

| Prepared Food | 1,910 | 1,890 | 1,908 | 1,930 | 2,020 | 5% | 1,931 |

| Fresh Vegetables | 1,871 | 1,807 | 1,878 | 1,884 | 1,981 | 5% | 1,884 |

| Fresh Fruit | 1,649 | 1,633 | 1,608 | 1,533 | 1,482 | -3% | 1,581 |

| Snack Foods | 1,332 | 1,315 | 1,355 | 1,408 | 1,364 | -3% | 1,355 |

| Non-Alcoholic Beverages* | 1,192 | 1,156 | 1,087 | 1,070 | 1,041 | -3% | 1,109 |

| Pork & Pork Products | 778 | 798 | 793 | 765 | 802 | 5% | 787 |

| Dog & Cat Food | 602 | 597 | 640 | 650 | 752 | 16% | 648 |

| Chocolate and Cocoa Products | 725 | 749 | 748 | 713 | 711 | 0% | 729 |

| Tree Nuts | 686 | 598 | 643 | 696 | 696 | 0% | 664 |

| Dairy Products | 554 | 630 | 637 | 641 | 666 | 4% | 626 |

| All Other | 9,689 | 9,135 | 9,311 | 9,581 | 9,236 | -4% | 9,391 |

| Total Exported | 20,988 | 20,307 | 20,608 | 20,871 | 20,751 | -1% | 20,705 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

*Excludes juices

Highlights

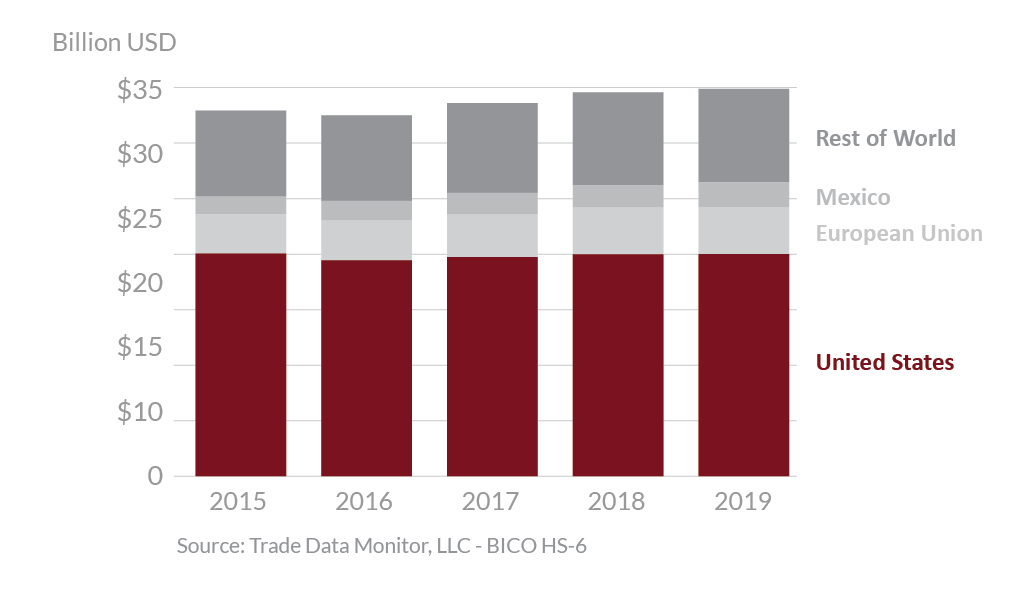

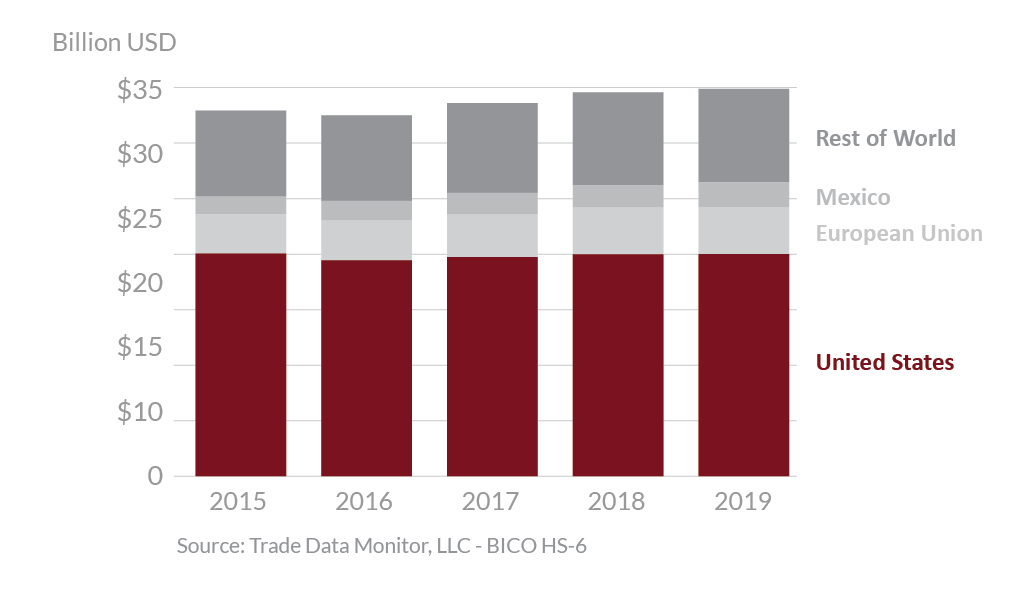

In 2019, Canada continued to be the top destination for U.S. agricultural exports, which amounted to $20.8 billion, down slightly from the 2018 value. Canada represented 15 percent of total U.S. agricultural exports. The United States was Canada’s largest trading partner for agricultural goods, capturing 58 percent of Canada’s import market, followed by the EU-28, with a 12 percent share. Although Canada had imposed 10 percent retaliatory tariffs until May 2019 on a number of agricultural products and the U.S. dollar remained strong, U.S. agricultural exports to Canada were resilient. Sales to Canada were driven by robust business relationships between Canadian buyers and their commitment to their U.S. suppliers. The largest export growth was seen in dog & cat food and fresh vegetables, up $101 million and $97 million, respectively, and increases in exports of prepared food, live animals, and pulses were up $89 million, $50 million, and $43 million, respectively. Exports of beef & beef products were down by more than $91 million. Exports of soybeans, poultry & meat (excluding eggs), and fresh fruit were down $88 million, $52 million, and $51 million, respectively. Despite these decreases, Canada in 2019 was the top market for U.S. prepared foods, fresh fruit, snack foods, processed vegetables, fresh vegetables, feeds & fodders, wine & beer, non-alcoholic beverages (not including juices), condiments & sauces, chocolate and cocoa products, dog & cat food, processed fruits, vegetable oils (excluding soybeans), live animals, fruits & vegetable juices, breakfast cereals, and other oilseeds including rapeseed and flaxseed.

Drivers

-

Processed foods such as prepared goods, snack foods, and beverages as well as fresh fruits and vegetables continue to be the top exports to Canada. Climatic conditions and geographic proximity provide the United States with a strong competitive advantage in supplying fresh goods to Canada while highly integrated supply chains and logistical advantages ensure the timely delivery of processed foods and retail-ready goods.

-

U.S. exports of beef and beef products fell by $91 million to its lowest value since 2009. Overall Canadian demand for beef imports from the world declined 13 percent by volume while the United States maintained its 63 percent market share. In terms of value, the U.S. maintained its nearly 70 percent market share while overall beef imports from the world declined by 27 percent.

-

U.S. exports of soybeans were down $88 million from the record value in 2018. In 2018, Canada took advantage of low prices to import a record volume of soybeans, thus dampening the need to import large volumes in 2019. The U.S. maintained a greater than 80 percent market share while overall imports by Canada were down.

-

For all dairy products, U.S. exports increased four percent, but outcomes within the sector were mixed. Milk-based drinks were up 33 percent to $82.6 million, and whey protein was up 20 percent to $70.5 million. Such increases more than offset decreases in exports of butter (33 percent) and other products.

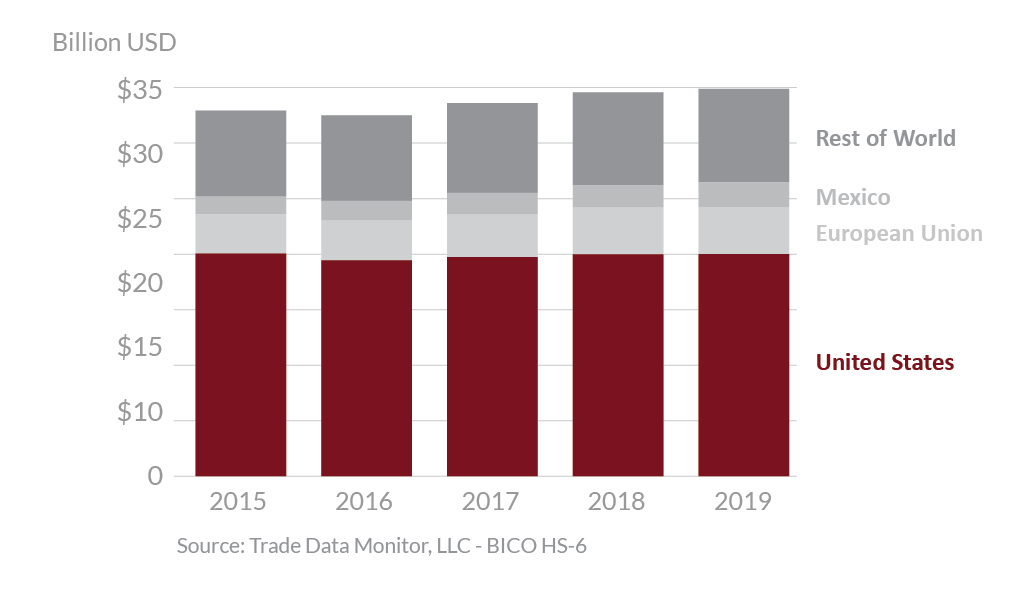

Canada's Agricultural Suppliers

Looking Ahead

The United States and Canada strengthened their long-standing free trade relationship through the negotiation and signing of the United States-Mexico-Canada Agreement (USMCA). USMCA implemented in July 2020, and ensures duty free access for nearly all agricultural commodities. Some of the achievements of the USMCA that should benefit the U.S. agricultural sector include expanded dairy and poultry access as well as the outcomes that address wheat grading policy and wine access. Over the next decade, Canada is projected to be one of the world’s largest importers of U.S. biofuels and remain a top market for U.S. ethanol.

Canada’s global poultry imports under NAFTA are constrained by a tariff-rate quota (TRQ) calculated as a function of Canadian chicken meat production in the preceding calendar year. USMCA provides a country specific TRQ for the United States, which should help preserve trade as the Canadian market evolves and becomes more competitive and open to new free trade agreement partners.

Canada remains active in expanding free trade agreements with other trading partners. TRQ access for third-country competitors will continue to grow in the coming years under two other free trade agreements. Canada recently implemented: the eleven-nation Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Comprehensive Economic and Trade Agreement (CETA) with the European Union. Given that Canada is a mature market with modest economic growth and a low population growth, further expansion of U.S. exports will be challenging. Additionally, there remains significant potential in greater penetration of francophone Canada, particularly Quebec.

The COVID-19 pandemic interjects considerable uncertainty into the global trade of food and agricultural goods. Slowing economic growth, high unemployment, reduced spending, and potential impacts on the food supply chain may dampen the demand for imported foods and agricultural goods.